Financial Aid

You don’t have to let cost stop you from pursuing your education. WWCC can help you figure out how to pay for college. Learn more about your financial aid options, from federal and private loans to grants and work studies.

Important News!

The biggest changes in 40 years will be happening in Financial Aid starting the 2024-2025 academic year. Are you ready?

To apply for financial aid, follow the steps below!

There are many types of financial aid available to help you cover the costs of tuition, books, and living expenses while you go to school. Follow the steps below and download the Financial Aid Guide for reference!

2024-25 guide and checklist are coming soon! In the mean time, follow the steps below to get your FAFSA/WAFSA submitted!

Step 2: Complete WWCC’s Financial Aid Information Form

Complete the 2023-24 Financial Aid Information Form for the current year and submit it to the Financial Aid Office.

23-24 Financial Aid Information Form

To submit, complete the form online and save it to your computer. Once saved, you can print it and bring it in, mail it, or email it to the WWCC Financial Aid Office.

2024-25 Financial Aid Information Form is coming soon!

Step 3: Stay up-to-date on your Award Status

Login to ctcLink via the mobile link. Follow these directions to review your financial aid award information.

ctcLink Mobile Login

Step 4: Submit Additional Documentation, If Required

If your FAFSA is federally selected for verification, you will be required to submit additional documentation to the Financial Aid Office. Verification is a review process where the Financial Aid Office ensures the accuracy of information reported on the FAFSA. Students are selected for verification by the Department of Education at the time they complete the FAFSA. Documents required for verification may include: Income Verification Form, Household Verification Form, tax transcripts or copies of 1040 tax forms and schedules, W-2 forms, verification of non-filing, and identity verification. Other documents may be requested as needed to resolve conflicting information found during verification.

Students who are selected for verification will be notified of the documents required through their “To Do” list in ctcLink. All required documents should be turned in by the priority processing date to complete your file. Financial aid funds will not be awarded until verification is completed.

If Selected, Click Here for More InformationRemember to report any changes

Other documentation may be required if you need your aid adjusted due to income changes, a change in credit load, or you need to file an appeal.

Other Documentation FormsStep 5: Award Notification

Students are notified by email (sent to their email account marked as preferred in ctcLink) with a financial aid offer when their application is processed. The initial aid offer assumes that students will enroll in 12+ credits each term, which is considered full-time. Revised offers are sent with each update to an award. Updates may occur when additional funds are received or awarded, or dollar amounts on existing awards are adjusted. Students are encouraged to review all changes and take the appropriate action for the awards offered.

Your financial aid award will first be applied to any outstanding tuition and fees. Any remaining funds will be refunded to you through BankMobile after the start of the quarter.

Students may still be eligible for aid at lower enrollment levels. If eligible below half-time, federal and state grant aid is prorated based on the chart below:

Enrollment |

Credit Load |

Eligibility |

| 9-11 credits | ¾ Time | 75% of the full-time grant award |

| 6-8 credits | ½ Time | 50% of the full-time grant award |

| 3-5 credits | Less than ½ Time | 25% of the full-time grant award |

| 1-2 credits | No financial aid eligibility |

Students who plan to enroll less than full-time (12 credits) will need to complete an Enrollment Change Form to confirm their enrollment level and request to have their aid adjusted to their planned enrollment level before disbursement of funds.

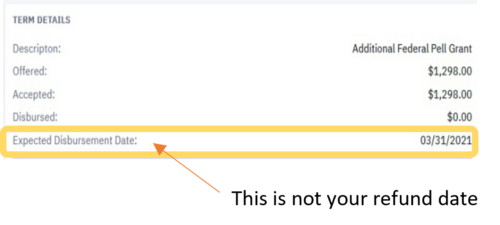

As a reminder, the disbursement date that displays in your financial aid account is the earliest date your financial aid award can be applied to any charges on your account (your tuition and fee charges). This usually happens one or two days before the quarter starts. WWCC then subtracts your charges from your award, and the difference will be your refund. Refunds are issued after the quarter begins to account for any schedule changes that may affect charges.

|

Financial Aid Policies

To receive and maintain your financial aid, you’ll need to agree to certain terms and conditions, including making satisfactory academic progress.